28+ mortgage loan self employed

Web To get a self-employed home loan apply after earning at least two years of steady income while working for yourself. Web While the SBAs most common loan program is the 7 a others can benefit self-employed workers in particular including SBA microloans.

Credit Counseling Center Richboro Pa

Find your net income from Schedule C on your tax returns for.

. No SNN Needed to Check Rates. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. A 35 down payment.

Web Todays 30-year mortgage refinance rate climbs 014. 2 Years most recent FILED Personal Business Tax Returns with all W2s 1099s K1s. NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

Keep tax deductions to a minimum. Web A Bank Statement loan is a mortgage for self-employed borrowers including 1099 earners. A debt-to-income ratio below 50 percent.

Ad Lock Your Mortgage Rate Today With Award-Winning Quicken Loans. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Some of the steps you should take.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Compare Mortgage Options Calculate Payments. Eligible self-employed borrowers can qualify for this loan type.

Web In order for a self employed person to qualify for a FHA loan they just meet the following requirements. Web The best way to increase your chances of being approved for a mortgage is to be prepared especially if youre self employed. It Only Takes Minutes to See What You Qualify For.

Highest Satisfaction for Mortgage Origination. The Best Lenders All In 1 Place. Discover The Answers You Need Here.

The process of obtaining a. Determine if you need a self-employed. You must have been consistently self-employed in the same line of work.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Get Instantly Matched With Your Ideal Mortgage Loan Lender. These loans range in.

Ad Create a Legally Binding Mortgage Agreement Through an Easy Step-by-Step Process. Web With that in mind here are a few tips to help you get approved for a mortgageeven if youre your own boss. Save Real Money Today.

Compare Mortgage Options Calculate Payments. Web Everything You Need To Know About self Employed Mortgage Loans In New Jersey And The Rest Of The United States In 2023. A FICO score of at least 580.

Web A Federal Housing Administration FHA loan is a mortgage that is insured by the Federal Housing Administration FHA and issued by an FHA-approved lender. Improve your credit score and correct any errors on your. Web Mortgage lenders consider both DTIs and typically want to see a front-end DTI of 28 or less and a back-end DTI under 43.

Raise your credit score and put down the. Additional reasons why self-employment may make it. Web Traditionally self-employed borrowers have a tougher time qualifying for a loan than a traditional borrower who receives a W-2 from their employer.

Web To qualify for the lowest mortgage interest rate possible as self-employed borrower follow these tips. Web Loan Officer Kevin OConnor has over 17 years of experience as a Mortgage Loan Originator and is a trusted resource for mortgage education and information. Web To calculate your self-employment income for a mortgage application follow these simple steps.

You can still be. The average 30-year fixed-refinance rate is 703 percent up 14 basis points from a week ago. Apply Now With Quicken Loans.

Home equity loans can range from. Web This can make it more difficult to prove steady income which can impact your chances of being approved for a mortgage. Learn from an expert what lenders will generally look for if youre a freelancer or gig worker and youre seeking a.

Save Time Money. Web Self-employed mortgage borrowers can qualify for conventional and government-backed loans. Web To get approved youll need.

Apply Online To Enjoy A Service. Youre more likely to get approved and have favorable loan. Web Can I Get a Mortgage If Im Self-Employed.

Its possible to find an FHA lender willing to approve a. Ad Lock Your Mortgage Rate Today With Award-Winning Quicken Loans. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

Web IF SELF-EMPLOYED or BORROWERS using COMMISSIONBONUS INCOME to qualify. Web 1 day agoThe most common repayment periods for mortgages are 15 and 30 years but some lenders offer 10 and 20-year terms as well. Low Fixed Mortgage Refinance Rates Updated Daily.

Apply Now With Quicken Loans. Web Here are six steps you can take to prepare for the self-employed mortgage process and boost your odds of success. Options for Mortgage Refinancing When Youre.

Self Employed Mortgages How To Obtain A Home Loan As A Self Employed Worker

Self Employed Learn How To Qualify For A Mortgage In 6 Easy Steps Trulia S Blog

Getting A Mortgage When Self Employed The Complete Guide

Ex 99d1g004 Jpg

Connie Coe Owner Self Employed Linkedin

Self Employed Home Loans Explained Assurance Financial

The 3 Year Plan To Challenge The Big Two Long Read Le Grove The Arsenal Opinion Blog

Self Employed Home Loans Explained Assurance Financial

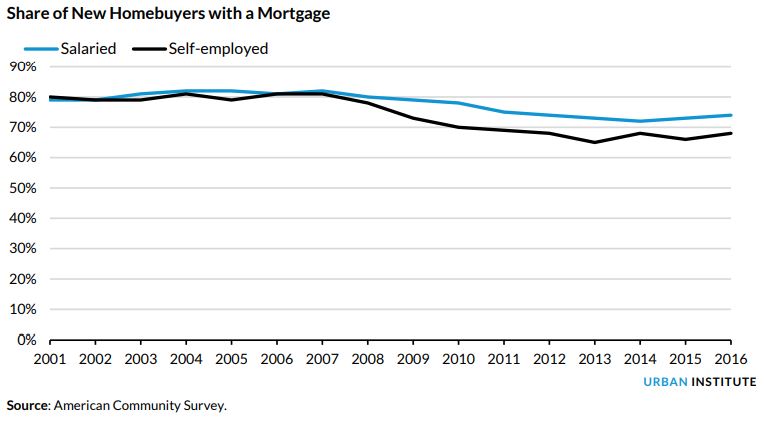

The Mortgage Market Is Not Meeting The Needs Of Self Employed Workers Urban Institute

56 Nassau Road Roosevelt Ny 11575 Mls 3372015 Howard Hanna

How To Get A Mortgage When Self Employed

Mortgages For Self Employed Borrowers An In Depth Guide Mfm Bankers

How To Get A Mortgage When Self Employed Forbes Advisor

Gary Basin On Twitter Casually Dropping A Litepaper On What I Ve Been Cooking For Four Years It S A Web3 Mortgage Brokerage It S Codenamed Pineapple It S Going To Reinvent Our Housing

Self Employed Mortgage Loan Requirements 2023

Free 10 Affidavit Of Self Employment Samples Signed Income Verification

Self Employed Less Than Two Years Mortgage Solution